Content

Explain why the Cash Flow Statement is identified as a financial statement. What are three examples of estimates that are used in accounting that are not contingencies? Explain why they are not considered contingencies. Explain how to account for contingent liabilities. Under what circumstances does the account Discount on Notes Payable arise?

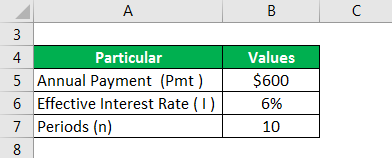

You recently applied for and obtained a loan from Northwest Bank in the amount of $50,000. The promissory note is payable two years from the initial issue of the note, which is dated January 1, 2020, so the note would be due December 31, 2022. In addition, there is a 6% interest rate, which is payable quarterly. A journal entry required at the time of issuing the note on November 1, 2018. The amount of discount charged by the lender represents the cost of borrowing which must be expensed over the life of the note rather than at the time of obtaining the loan.

However, notes payable are always mentioned as liabilities on the balance sheet. Long-term notes payable are to be measured initially at their fair value, which is calculated as the present value amount. It is a discounted cash flow concept, which we will discuss next. For accounting purposes, discounts on notes payable are treated as an interest expense. The dollar amount of the discount is entered on the issuer’s books over the life of the note.

A contra liability account arising when the proceeds of a note payable is less than the face amount of the note. The debit balance in this account will be amortized to interest expense over the life of the note.

The company owes $31,450 after this payment, which is $40,951 – $9,501. The company owes $40,951 after this payment, which is $50,000 – $9,049. In the following example, a company issues a 60-day, 12% interest-bearing note for $1,000 to a bank on January 1.

If current assets will be used to retire the bonds, a Bonds Payable account should be listed in the current liability section. See below for the balance sheet reporting treatment of the current and long-term liability portions of the Note Payable from initiation to final payment. A note payable is a liability where one party makes an unconditional written promise to pay a specific sum of money to another.

A discount on notes payable occurs when the note`s face value is greater than its carrying value. It represents the added interest that must be paid over the life of the note. A contra liability account for notes payable would be called the discount on notes payable.

Describe the statement of cash flows, and explain why it is important. If you’re looking for accounting software that can help you better track your business expenses and better track notes payable, be sure to check out The Ascent’s accounting software reviews. There are other instances when notes payable or a promissory note can be issued, depending on the type of business you have.

Maker-the maker of a note is the party who receives the credit and promises to pay the note’s holder. Join our community and stay up to date on the latest purchasing and payments content. While these steps are possible using a manual process, the volume of accounts and invoices in most companies requires automation to fully realize savings and control. Many businesses operate across several sites and via separate departments that replicate similar activities. It is common for the same goods and services to be needed by these separate departments and sites.

The following is an example of notes payable and the corresponding interest, and how each is recorded as a journal entry. Of course, you will need to be using double-entry accounting in order to record the loan properly. Notes payable is a formal contract which contains a written promise to repay a loan. Purchasing a company vehicle, a building, or obtaining a loan from a bank for your business are all considered notes payable. Notes payable can be classified as either a short-term liability, if due within a year, or a long-term liability, if the due date is longer than one year from the date the note was issued. On February 1, 2019, the company must charge the remaining balance of discount on notes payable to expense by making the following journal entry.

Endereço: Rua dos Industriários, 1053 – Bairro Novo das Indústrias Belo Horizonte/MG

Horário de Funcionamento: Segunda a Sexta 08:00 às 18:00.

© D&R Alambiques